In just a few years, the digital advertising market has been transformed by changes in advertising practices and the huge influx of complex technical innovations. So publishers now have a problem finding their way around and effectively optimising their advertising gains, while their resources are sometimes lacking. Implementing an effective price floor strategy is one of the many parameters to be taken into account to maximise advertising revenue. But what is a price floor? Why is it important to choose the right pricing strategy? And which is the best one? Everything is explained in our article.

The Principle of Price Floors in Programmatic Advertising

According to Marketing-Definitions (French online encyclopaedia about marketing), a price floor, also known as a floor price, is a “minimum auction price specified by the advertising medium on the SSP through the bid request”. This is the value below which an advert cannot be sold in an ad server. In other words, a price floor prevents advertisers from buying at a price lower than a certain amount, thus guaranteeing minimum revenue per impression for the publisher.

If it is set correctly, the price floor is good for the audience, who may benefit from adverts that are often more qualitative. In effect, lower-quality adverts are usually sold at a cost lower than that set by the price floor.

But finding the ideal price floor is not obvious for the publisher: if it is too high, it can result in an increase in unsold inventories and have a significant impact on total advertising revenue. This is why it is key to choose the right strategy for your media.

The Various Price Floor Strategies

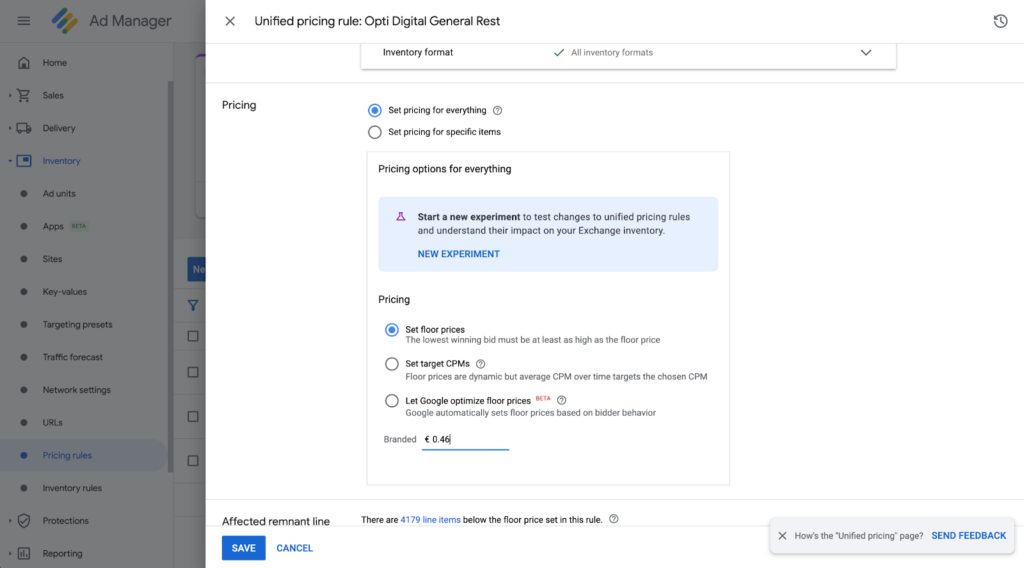

There are now several price floor techniques that can be set in the Google Ad Manager Ad Server. A price floor can be applied to all inventories on a site or be dependent on well-defined targeting criteria: by advertising location, device, country or format type, for example. Price floors can also be applied in each SSP.

The Static Price Floor

A static, or hard, price floor is an amount set by the publisher as a minimum price for its advertising inventories. This strategy is used to obtain the highest prices on advertising that attract more commitment. This strategy means that certain undesirable advertisers can be avoided, so as to offer visitors qualitative and profitable adverts.

On the other hand, there are some drawbacks with static price floors:

- Setting a price that is too high can represent a loss of earnings in addition to reducing the fill rate.

- The price floor needs to be changed regularly and the context (seasonality, day of the week, time, events, etc.) taken into account, otherwise publishers can miss out on opportunities relating to sales and revenue.

- Therefore, this strategy can lead to a reduction in the number of displays and a lower RPM than in the context of a strategy with target CPM.

The Target CPM

The target CPM enables the fill rate and profitability to be increased, while maintaining an average minimum price for inventories. The aim of this strategy is to achieve an average eCPM that is usually higher than for static price floors.

The advantage of the target CPM is that it protects publishers should there be several bids below the set price. The target CPM allows campaigns with a slightly lower CPM to be disseminated, so as to optimise the fill rate. This flexibility is offset by the tool with other sales opportunities at a price higher than the target CPM.

The disadvantage is the lack of transparency: this variable limit is only visible to the Google Ad Exchange marketplace. The other partners connected through header bidding are unaware of the minimum limit before submitting their bids.

Dynamic Price Floors

Recently, Google has been offering a beta version of a new price floor strategy in its Ad Server: Optimize floor prices. Driven by an intelligent algorithm, the strategy means that publishers can maintain competitive prices for their adverts, while leaving Google to set the minimum price. If the demand for inventories is low, then the price floor will also be low. Conversely, if demand is high, the price floor will be higher.

Dynamic price floors can be beneficial for publishers as they guarantee a fair value for inventories, based on bidders’ participation in auctions.

However, there are limits to this strategy:

- Dynamic price floors take fluctuation in demand into account, which can result in a price variation for the same inventories, potentially creating some frustration for buyers.

- This increases the lack of transparency and strengthens the dominant position of Google Ad Exchange over other SSPs as these price floors are only visible to Google Ad Exchange and Open Bidding, but they are imposed on all marketplaces. SSPs connected via Prebid and Amazon have to continuously adjust their auctions.

Although these three methods enable impairment of inventories to be avoided, today they present major limitations.

A new strategy will soon be available, thanks to Opti Digital. In fact, our product team, formed from data scientists, engineers and computer programmers, is putting the finishing touches to an intelligent price floor optimisation technology, calculated according to many criteria (history, page, location, time, days of the week, etc.). Offering more transparency to all demand partners, dynamically applied price floors will be communicated to all ad exchanges connected to Google Ad Manager: Prebid, Amazon, Google Ad Exchange and Open Bidding. It is in beta on a portion of our media traffic, and we are already observing an average increase of 40% in their advertising gains…

Don’t hesitate to click here: Dynamic Price Floor Optimisation or contact us to find out more: contact form